2025 Withholding Forms. By now, you have probably heard about project 2025. 2024 withholding income tax payment and return due dates.

Whether opting for taxation under section ? The latest versions of irs forms, instructions, and publications.

At This Point, Estimate Your 2021 Tax Return Now On Efile.com Before You Prepare And Efile Your 2021 Tax Return By April 18,.

Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns.

In Addition, Tax May Be Withheld From Certain Other Income, Such As Pensions,.

If you are an employee, your employer probably withholds income tax from your pay.

2025 Withholding Forms Images References :

Source: keelybangelle.pages.dev

Source: keelybangelle.pages.dev

Federal Withholding Tables 2025 Bobbie Christina, Exemption from maryland withholding tax for a qualified civilian spouse of military. Click here to view relevant act & rule.

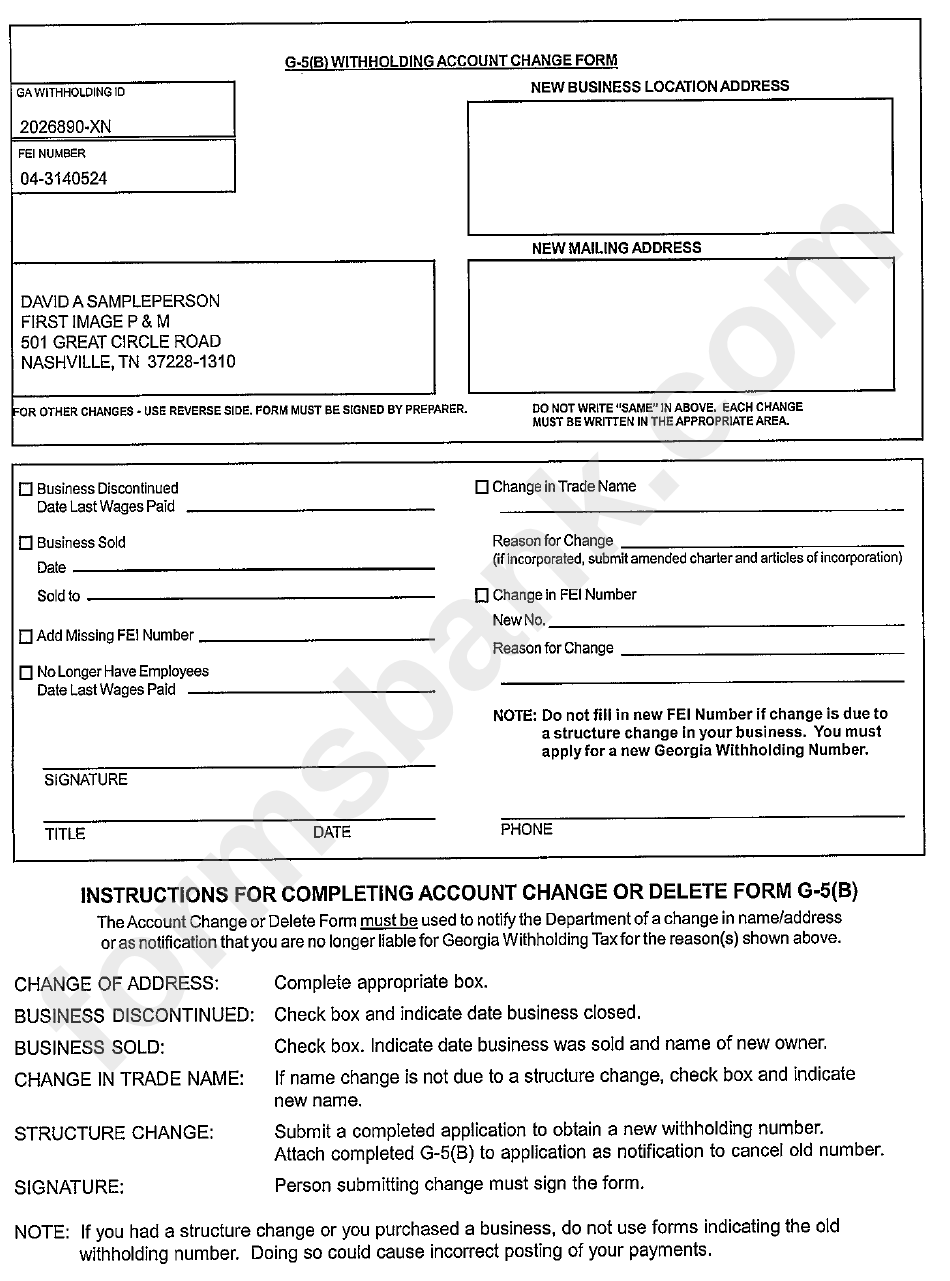

Source: www.withholdingform.com

Source: www.withholdingform.com

Employer Quarterly Withholding Tax Return Form, California withholding schedules for 2025. Federal withholding tables determine how much money employers should withhold from employee wages for.

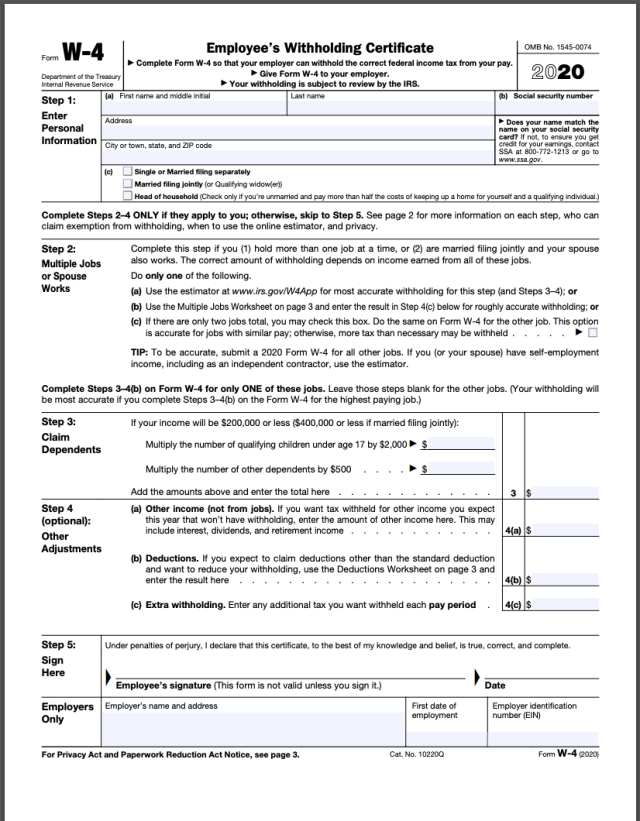

Source: www.employeeform.net

Source: www.employeeform.net

Al Employee Withholding Form 2024, Income with the paycheck calculator. 2024 withholding income tax payment and return due dates.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg) Source: www.investopedia.com

Source: www.investopedia.com

W4 Form How to Fill It Out in 2022, View more information about using irs forms, instructions, publications and other item files. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.

Source: www.employeeform.net

Source: www.employeeform.net

Social Security Employee Withholding Form 2023, Withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. California has four state payroll taxes which are.

Source: www.dochub.com

Source: www.dochub.com

Ps form 2025 Fill out & sign online DocHub, Form used by civilian spouse to direct their employer to discontinue maryland withholding. Tax year 2025 tax rates and brackets.

Source: www.withholdingform.com

Source: www.withholdingform.com

Form To Change Withholding For Taxes, Tax calculator and estimator for taxes in 2025. This information is included in the california employer’s guide (publication de 44).

Source: www.dochub.com

Source: www.dochub.com

withholding forms Fill out & sign online DocHub, Income with the paycheck calculator. The exemption applies to forms 1042 required to be filed in 2024 with respect to tax year 2023.

Source: money.yahoo.com

Source: money.yahoo.com

New W4 Adjusting your tax withholdings just changed, Click here to view relevant act & rule. Tax calculator and estimator for taxes in 2025.

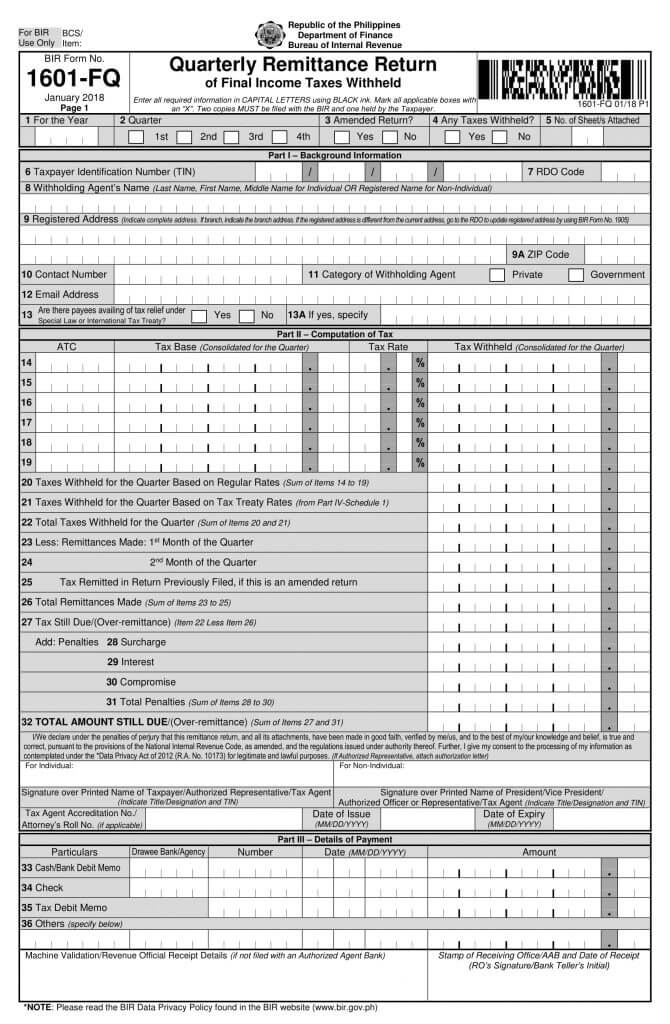

Source: www.bybloggers.net

Source: www.bybloggers.net

Bir Withholding Tax Form 5 Advantages Of Bir Withholding Tax Form And, President joe biden certainly hopes so. Estimate and plan your 2025 tax return with the 2025 tax calculator.

What Does Exempt From 2025 Withholding Mean.

Tax year 2025 tax rates and brackets.

The Exemption Applies To Forms 1042 Required To Be Filed In 2024 With Respect To Tax Year 2023.

Utilizing deductions worksheet for withholding.