Estimate My 2024 Tax Refund. The quickest way to estimate how much your tax refund will be is to use the group certificate your employer will provide to you within the first couple of weeks in. Get a rough estimate of how much you’ll get back or what you’ll.

This tax return and refund estimator is for tax year 2024. Enter a few details to see your potential refund in minutes.

Get A Quick, Free Estimate Of Your 2023 Income Tax Refund Or Taxes Owed Using Our Income Tax Calculator.

Use our simple 2023 income tax calculator for an idea of what your return will look like this year.

Use This Service To Estimate How Much Income Tax And National Insurance You Should Pay For The.

Estimate your federal income tax withholding;

Answer Questions To Learn About Your Tax Situation &Amp; Refund Estimate.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Estimate your refund or bill our federal income tax calculator. Just answer a few simple questions about your life, income, and expenses, and our free tax calculator will.

Source: www.youtube.com

Source: www.youtube.com

How To Calculate Your Tax Refund FREE in 5 Minutes, Calculate Tax, 1040.com’s refund calculator is the easiest way to estimate your taxes and tax refund. 2024 tax refund date estimator.

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Tax Refund Calendar 2024 Calendar Printable, 1040.com’s refund calculator is the easiest way to estimate your taxes and tax refund. Enter a few details to see your potential refund in minutes.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Source: alydaqmargalo.pages.dev

Source: alydaqmargalo.pages.dev

Irs Updates On Refunds 2024 Nerty Tiphanie, The average tax refund issued by the irs as of march 1 is $3,182, a 5.1% increase compared to the similar filling. 1040.com’s refund calculator is the easiest way to estimate your taxes and tax refund.

Source: www.refundstatus.com

Source: www.refundstatus.com

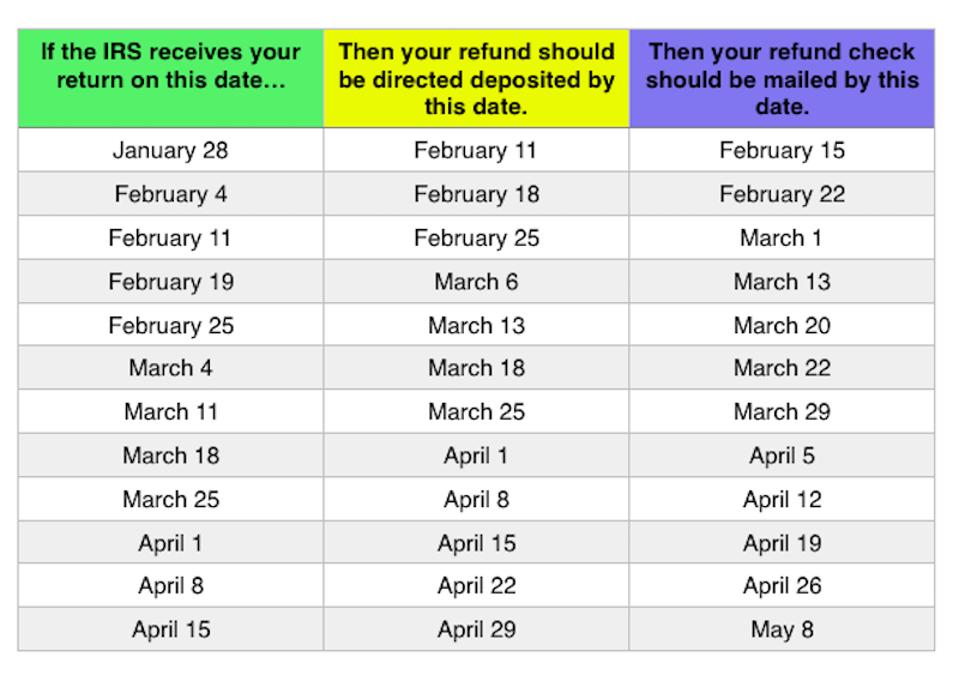

Refund Cycle Chart Online Refund Status, This calculator is updated with. 2024 tax refund date estimator.

Source: www.zrivo.com

Source: www.zrivo.com

Tax Refund Estimator 2023 2024, Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Add all your income types e.g.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Tax Refund Chart Printable Forms Free Online, See your personalized refund date as soon as the irs processes. The quickest way to estimate how much your tax refund will be is to use the group certificate your employer will provide to you within the first couple of weeks in.

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Tax return calculators for back. Estimate your refund or bill our federal income tax calculator.

Source: www.checkcity.com

Source: www.checkcity.com

The IRS Tax Refund Schedule 2023 Where's My Refund?, Just answer a few simple questions about your life, income, and expenses, and our free tax calculator will. Feel confident with our free tax.

March 25, 2024 11:15 A.m.

See your personalized refund date as soon as the irs processes.

Add All Your Income Types E.g.

Use our simple 2023 income tax calculator for an idea of what your return will look like this year.